Art as an Asset Class

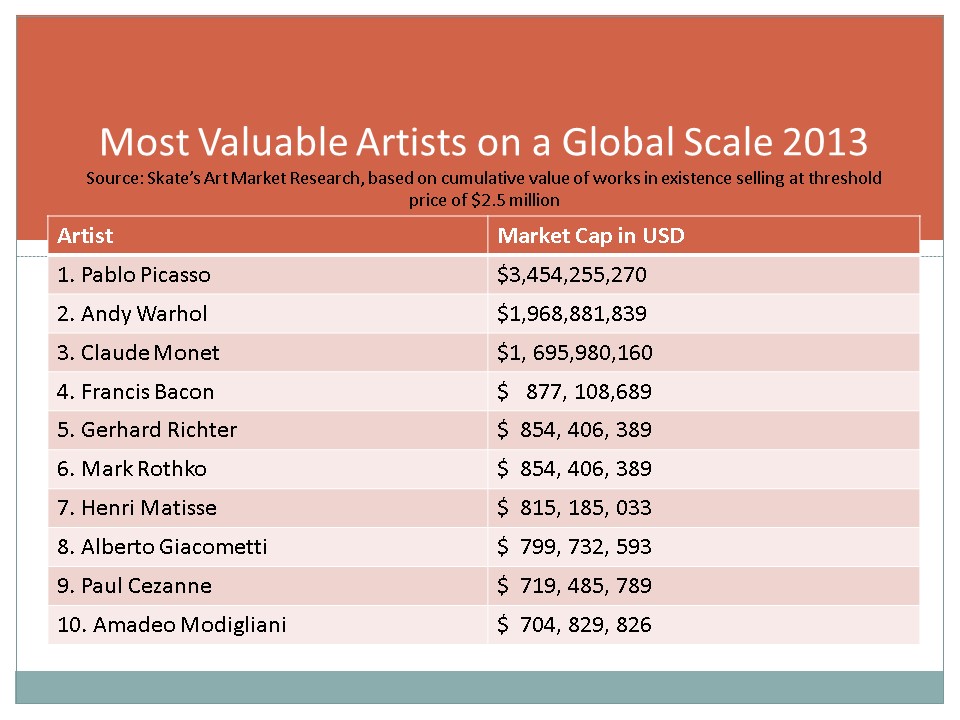

Art advisor and appraiser Michelle DuBois of Winston Art Group led a discussion this morning on art as an asset class. This topic has been frequently written about in the financial press as a result of the art market achieving record prices. In May 2015, Christie’s auction house sold $1 billion worth of art in just three days.

The rise in prices, combined with increased collecting by ultra-high net worth individuals, has lead wealth management professionals to take a more holistic approach to their clients’ portfolio, including a strategic focus on estate planning, tax and succession planning as it pertains to art and collectibles. JDJ has integrated customized tools in our accounting databases in order to accurately track and report on their art assets.

The art market is unregulated and falls short of meeting the legal expectations of an asset class, particularly in terms of regulatory structures, information availability and clear title. The wealth management community has many regulations and requirements that are entirely lacking in the art market. The opaqueness of information, lack of indices, and authentication issues are all troubling to the wealth management community and reinforce the need for trusted advisors.

Another consideration – in the case of art or collectibles, it is essential that adequate insurance coverage, disaster mitigation plans, and estate plans are in place to protect the family’s assets and ensure the intended legacy of the pieces.

While we believe art is not truly an asset class as defined by the financial industry, it can represent a significant portion of a family’s net worth. Planning for and protecting these collectibles should be a part of responsible wealth management practices.

Thanks to Michelle DuBois for sharing her insights and expertise on this fascinating topic.